Get ready

Each organisation has their own form of contract. Each contract needs to be reviewed to ensure it is relevant to your particular situation. These documents need to be very detailed and cover off every possibility.

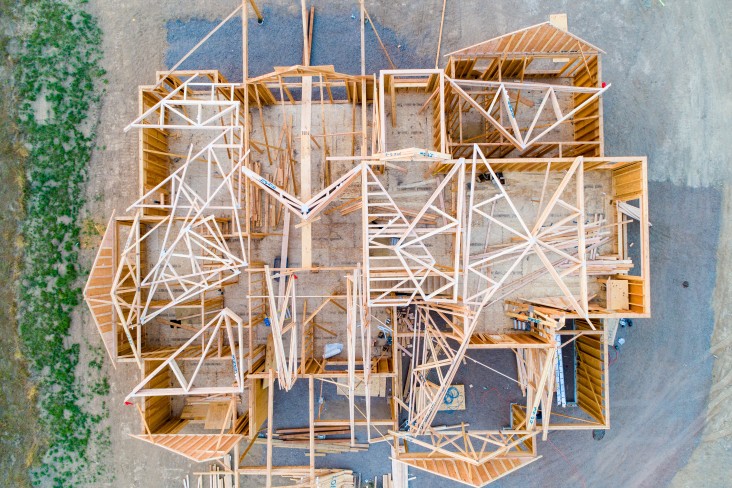

Get started

- Have a look around to see what designs you like

- Talk to the builder to see if they may be able to create the design you are after.

- During the planning phase, you will need to think of everything, right down to the last light switch and tap.

- From there, you will be able to work out detailed plans and specifications, obtain a quote/s and finalise the contract.

Key things to consider

- Are the plans and specifications sufficiently detailed to ensure you get what you’re expecting?

- What guarantee do you have for the work carried out? E.g. Master Build Guarantee?

- Is the price 'fixed' or does the builder have the ability to pass on additional costs to you?

- If you are getting funding, has your bank looked at your agreement and approved the funding and general terms? You can usually do interest-only repayments during construction to keep costs down - this is generally on a floating interest rate, and once construction is complete you can fix.

- When is the final payment due? Will it be after Code of Compliance Certificate (CCC) or practical completion?

How much is it going to cost?

'No surprises' is our motto. We want to be upfront on what the property transaction you are embarking on is going to cost you so you can manage your budget. The cost will include the fees you pay for our work but also other related expenses such as council fees and Land information registration fees.