Recent headlines in Stuff read “Couple stunned as bank takes half of home sale profit without consultation”. This must have been frustrating for the couple but highlights a general lack of understanding of how a 'mortgage’ actually works and some poor communication by people advising the couple.

Let’s keep this simple and break down what actually happens when you borrow money from the bank. Once you have your heart set on a house, you trot along to the bank to ask for some money to buy it and once they have done their checking, the bank is usually happy to provide it. We commonly call this funding a 'mortgage’ but we need to clarify what getting a 'mortgage’ means.

The funding arrangement is in two parts. The bank provides you with money to help buy the house in exchange for your promise to make the repayments on the due date, pay the rates and have the house insured, and so on. This is recorded in the loan agreement and is just like any other contract. The bank, however, is wary of your promise and asks for security over the house just in case you don’t pay. This is another document that you sign and is called the 'mortgage’ which is attached to your house and will appear on your Record of Title.

Ultimately, the bank can sell the house if you stop paying or breach any of the obligations in the loan agreement. The two components of the financial arrangement with the bank are important to remember as we discuss the different security arrangements the bank can impose. Now, let’s compare two arrangements to help illustrate the different concepts.

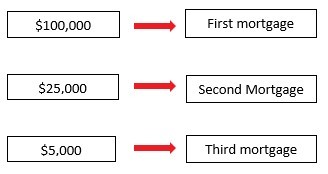

Those of you who are more senior readers may be more familiar with the concept of a fixed mortgage. In a time when life may have been simpler, and most people just had a family home, you would get your loan and the mortgage would be registered on the title as a first mortgage. If you got a second loan, a second mortgage was registered on your title. So, it might look like this:

When you paid back the money, the first loan to be paid back was the $5,000. Once this was repaid, the third mortgage security would be removed. And so on with each mortgage. In this scenario, the loan and mortgage security are connected.

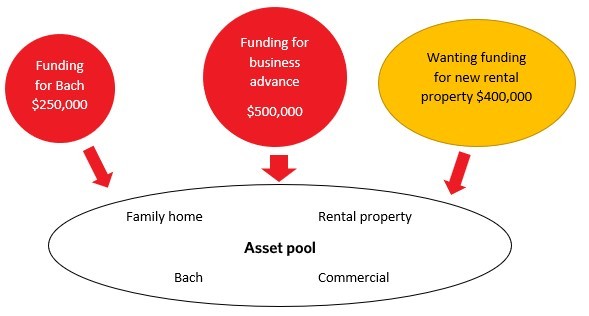

However, life is a little more complex these days, and this structure gives little flexibility for people to buy other properties using their existing assets as security. To address this, the banks use an 'all obligations’ mortgage. Banks now look at your assets as one pool, grouping them together as one nest. This illustration may help clarify:

Now, let’s say you want to buy a new rental property costing $400,000. You have some cash but need to raise $380,000.00. Because there is little equity in the new rental property, the bank will assess your equity value across all your properties and see there is plenty as your assets total $4.5 million, and the current lending is only $750,000. Happy days!

However, this flexibility is a two-way street. If you default on the loan you used to buy the bach, the bank can look at the pool of assets and decide to sell the family home as this property will be a better bet to recover all the money owing as well as the outstanding interest. Remember, your bank doesn’t look at the asset the loan was used for, they only look at the pool of assets and decide which one is best to use for 'all your obligations’ to the bank.

The same principle works when you decide to sell a property. The bank will always be monitoring your asset pool and deciding whether you can repay the level of debt, and whether the value of the properties is sufficient for their security purposes.

This is what happened with the Dunedin couple. The bank assessed their position at the time the rental property was sold and adjusted their debt levels according to property values and the couple’s personal financial position.

The lesson here is to talk with your bank early if you’re thinking of selling a property or changing your personal circumstances. That way, you’ll avoid any surprises further down the track.